75+ Important Online Payments Statistics, Data, and Trends (2025)

Whereas creating our personal on-line shops, we realized one key lesson about on-line funds: you must provide the fee strategies your prospects want.

Get this incorrect, and you can lose a number of your potential gross sales.

Because of this we nonetheless look intently at digital funds statistics. The extra you perceive your prospects’ fee behaviors, the extra probably they’re to buy your merchandise.

So, when you’re fascinated by studying extra, we’ve gathered crucial on-line fee statistics, information, and information. Let’s see how you should utilize these insights to spice up your gross sales.

The Final Record of Digital Funds Statistics

We’ve dug deep into trade stories and our personal expertise to carry you crucial fee insights.

That can assist you discover precisely what you’re on the lookout for, we’ve organized these on-line funds statistics into easy-to-navigate sections under:

Fast observe: Once we speak about on-line funds, we imply any methodology that makes use of the Web—from eCommerce checkouts to contactless funds at brick-and-mortar shops.

Normal On-line Cost Statistics

First, let’s take a look at the large image of on-line funds. These statistics reveal the unimaginable progress and influence of digital funds in right this moment’s enterprise world.

1. 9 out of 10 shoppers have used digital funds.

This widespread adoption of digital funds isn’t only a pattern – it’s changing into the norm. Extra persons are selecting digital fee strategies for each on-line purchasing and in-store purchases.

For enterprise house owners, this implies providing digital fee choices isn’t only a good factor anymore. It’s important for staying aggressive. In any other case, you may push prospects away and unintentionally trigger them to abandon their carts.

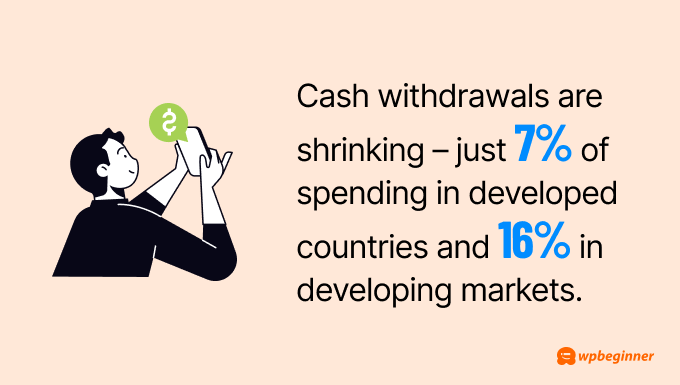

2. Money withdrawals are shrinking – making up simply 7% of spending in developed international locations and 16% in growing markets.

These numbers inform an essential story concerning the decline of money funds worldwide.

Even in growing markets the place money was as soon as king, digital funds are gaining floor quick. This shift reveals that companies in all places want to arrange for a extra cashless future.

3. Cell point-of-sale leads the digital fee sector, with specialists predicting it’s going to course of $12.56 trillion in transactions by the tip of 2025.

Even when you run a standard brick-and-mortar retailer, your prospects count on to pay with their telephones. Providing digital fee choices at your point-of-sale system will help you keep away from shedding gross sales to opponents who do.

Plus, prospects recognize the comfort of not having to hold bodily playing cards.

Extra Normal Digital Funds Stats

- Knowledgeable forecasts present the web fee trade will bounce in worth from $103.2 billion in 2023 to $160.0 billion by 2028.

- Digital funds are set to deal with $20.37 trillion in transactions in 2025.

- Retailers spend about $138 billion yearly on on-line fee processing charges.

- Exterior of China, Visa and Mastercard deal with 90% of all on-line funds worldwide and are price round $850 billion mixed.

- With regards to utilizing payment gateways, large corporations make up 55% of all transactions processed, whereas small and medium companies deal with 45%.

Well-liked Digital Cost Strategies and Processors

Subsequent, let’s see who’s powering on-line funds behind the scenes. These statistics present which fee processors dominate the market and the way prospects select to pay via them.

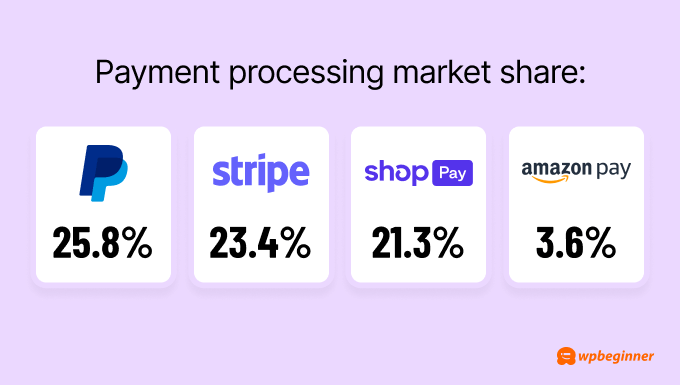

4. PayPal leads the fee processing market share (25.8%), adopted intently by Stripe (23.4%), Shopify Pay (21.3%), and Amazon Pay (3.6%).

Cost processors are the businesses that deal with the behind-the-scenes work of transferring cash out of your buyer’s account to yours. They confirm the fee data, test for fraud, and ensure the funds are transferred securely.

Whereas PayPal has lengthy dominated this area, Stripe has grown quickly. We regularly suggest Stripe as a result of it gives extra options and sometimes has decrease charges.

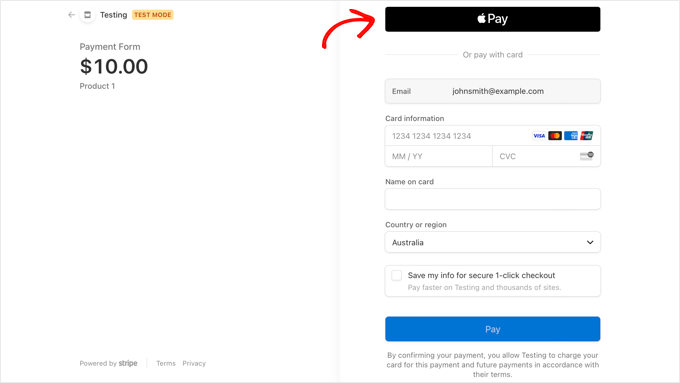

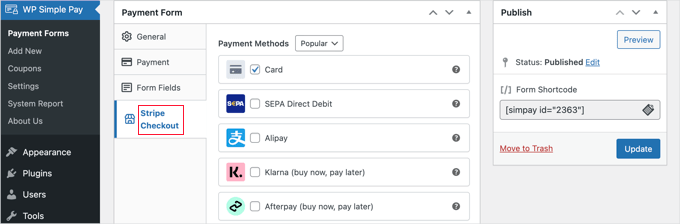

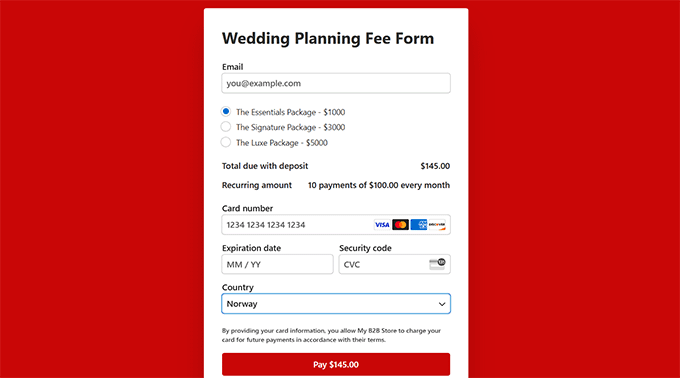

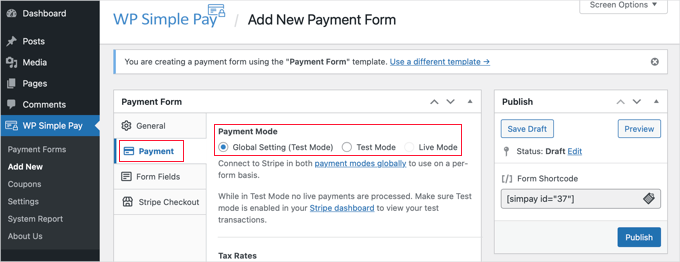

Plus, many WordPress fee plugins, like WP Simple Pay, are constructed particularly to work with Stripe. That is what we recommend enterprise house owners use in the event that they don’t need to use a full-fledged eCommerce platform.

You may be taught extra concerning the plugin in our detailed WP Simple Pay review.

Shopify Pay has additionally gained floor due to the increase in on-line shops, whereas Amazon Pay leverages the belief of the Amazon model.

5. Most individuals want paying for his or her on-line transactions with digital wallets (50%), adopted by bank cards (22%) and debit playing cards (12%).

It’s not shocking – digital wallets are quicker than getting into card particulars, typically safer, and let buyers pay utilizing funds from a number of sources.

Including digital pockets assist to your web site is simpler than you may assume. As an example, WP Easy Pay comes with built-in assist for common digital wallets like Apple Pay and Google Pay. This fashion, you gained’t miss out on potential gross sales.

What’s extra, you get useful options like fee type templates, recurring payments, and location-based tax calculations. These instruments make it simple to create an expert fee expertise on your prospects.

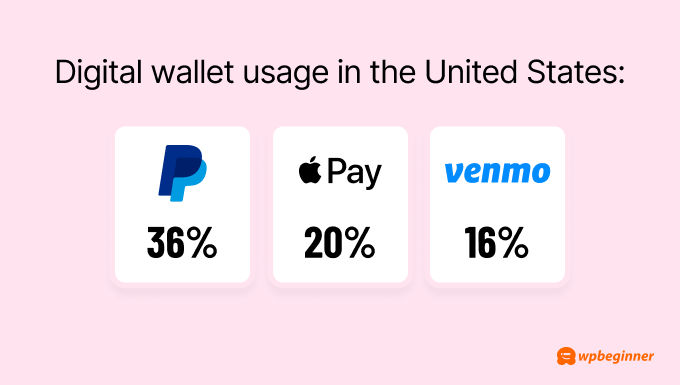

6. In america, PayPal dominates digital pockets utilization (36%), whereas Apple Pay (20%) and Venmo comply with (16%).

These platforms lead the market as a result of they’ve earned consumer belief and are simple to make use of. PayPal‘s early begin in eCommerce has made it a family identify, whereas Apple Pay’s seamless integration with iOS gadgets makes it handy for iPhone customers.

Then again, Venmo‘s social fee options have captured the peer-to-peer market, particularly amongst youthful customers.

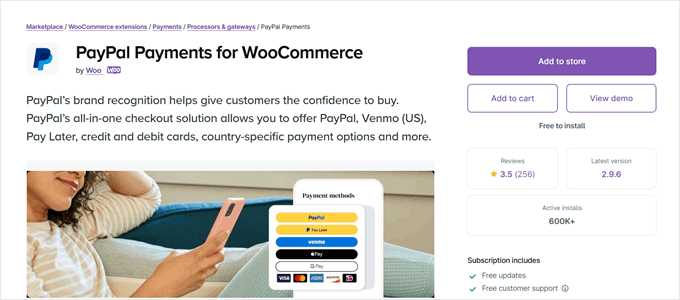

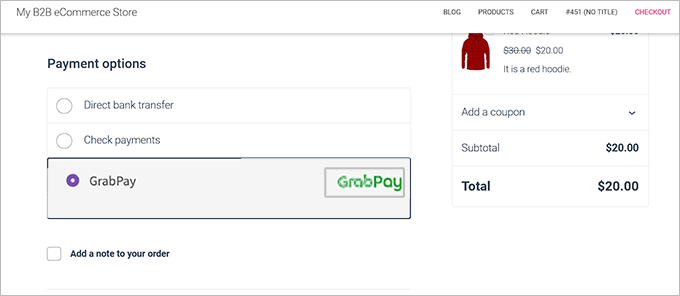

Including these common fee strategies to your WordPress website is easy. If you wish to run a web-based retailer, you should utilize WooCommerce, because it helps all these choices via its fee extensions.

In case you promote digital downloads, then we suggest Easy Digital Downloads as a substitute. It’s what we use to promote our WordPress plugins, and it’s been a dependable resolution for us for a few years.

The plugin comes with built-in assist for main digital wallets like Apple Pay, Google Pay, PayPal, Money App, and extra. Yow will discover out extra concerning the platform in our Easy Digital Downloads review.

7. The variety of customers with 3 or extra digital wallets has dropped by 10%, whereas single-wallet customers have elevated by 10%.

This pattern reveals that folks want simplicity of their fee strategies. Nonetheless, since completely different prospects want completely different wallets, companies nonetheless want to supply a number of choices to maximise their attain.

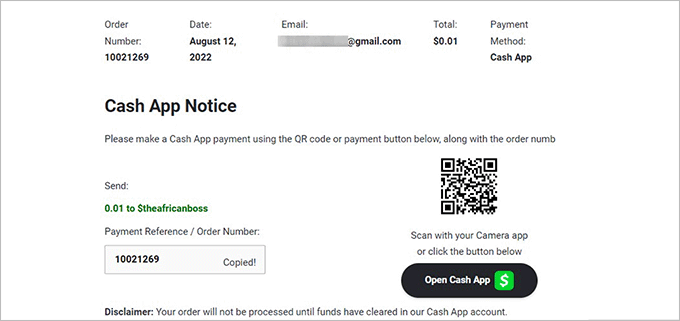

When selecting which fee strategies to supply, contemplate the place your prospects are positioned. For instance, in america, Cash App is changing into more and more common, particularly among the many youthful generations.

European international locations typically have their very own most well-liked strategies – like Bancontact in Belgium and iDEAL within the Netherlands.

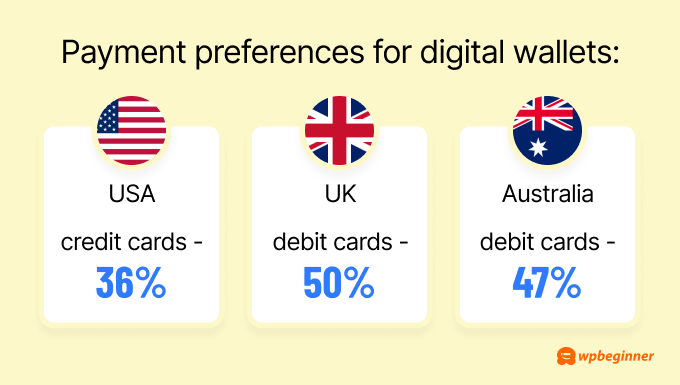

8. When funding their digital wallets, fee preferences differ by nation. Individuals want bank cards (36%), whereas British and Australian shoppers favor debit playing cards (50% and 47%).

Although digital wallets have turn into the most well-liked approach to pay on-line, credit score and debit playing cards aren’t going wherever. In spite of everything, these playing cards are how most individuals add cash to their digital wallets within the first place.

Plus, having conventional credit and debit card payment options offers your prospects a backup methodology when their digital wallets aren’t working.

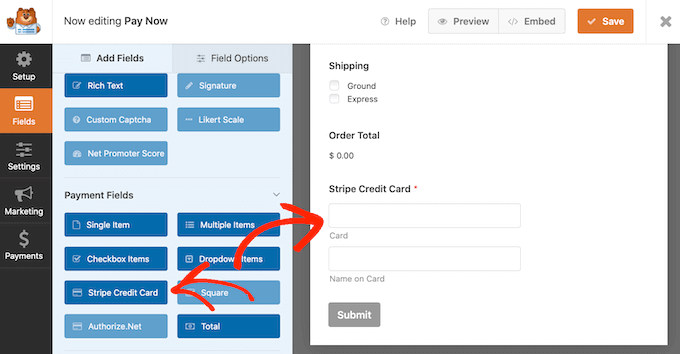

Other than WP Easy Pay, you too can use a type plugin like WPForms to simply accept funds in your web site. It’s what we use to create contact types on WPBeginner and different websites.

That is one other nice choice when you promote just a few services or products and simply need a easy fee type. WPForms integrates with each PayPal and Stripe, so you may settle for all main fee strategies with none sophisticated setup.

For extra data, you may take a look at our information on how to easily accept credit card payments in WordPress.

Extra Well-liked On-line Funds Statistics

- PayPal continues to point out robust utilization, with 40% of US adults utilizing it for on-line purchases.

- Stripe powers over 1.597 million web sites worldwide.

- Stripe provides about 1,000 new companies each day.

- Digital wallets course of 50% of worldwide eCommerce spending and 30% of worldwide point-of-sale spending.

- For in-store purchases, fee strategies are extra evenly cut up: digital wallets lead at 30%, adopted intently by bank cards (27%) and debit playing cards (23%).

- On-line person-to-person (P2P) funds make up 22% of all digital transactions.

- 24% of US adults use Apple Pay for on-line transactions.

- Money App has turn into a significant participant, now utilized by 115 million Individuals.

- In China, Alipay reveals spectacular each day utilization, with 45% of adults utilizing it each day and one other 41% weekly.

- About 80 million retailers settle for AliPay funds.

Client Cost Conduct & Demographics

Let’s now take a look at how prospects make selections about funds and what influences their shopping for conduct.

9. 75% of shoppers need to use their most well-liked fee methodology when purchasing.

Have you ever ever discovered the right product on-line, solely to comprehend that the shop doesn’t settle for your most well-liked fee choice? You’re not alone. Many customers would assume twice and even abandon their buy if they’ll’t use their favourite fee methodology.

Having a fee type that gives a number of fee choices will make your prospects really feel extra comfy shopping for from you. This flexibility will help scale back cart abandonment and enhance your gross sales.

However don’t fear. Providing this function is just not that sophisticated.

For WordPress customers, you may be taught extra about setting this up in our information on how to let users choose their payment method in WordPress.

10. PayPal customers store 60% extra typically in comparison with individuals who use different fee strategies.

This statistic is sensible when you think about PayPal’s widespread acceptance throughout on-line shops. When prospects know they’ll use their PayPal account nearly wherever, they’re extra prone to make purchases with out hesitation.

This increased buy frequency additionally reveals how a lot prospects worth acquainted, trusted fee strategies. After they see a fee choice they’ve used efficiently earlier than, they really feel extra assured about shopping for.

11. 80% of shoppers say a clean fee course of issues greater than different on-line purchasing options.

Your retailer’s fee expertise could make or break a sale. Even if in case you have nice merchandise and aggressive costs, a sophisticated checkout course of may drive prospects away.

This goes past simply providing the appropriate fee strategies. Small particulars matter, like exhibiting the entire price upfront, together with taxes and shipping fees. This fashion, there aren’t any hidden surprises which may make prospects abandon their carts on the final minute.

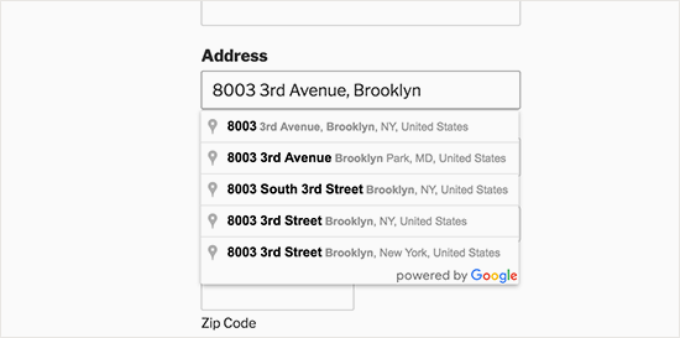

Additionally, you will need to add autocomplete for address fields in order that prospects don’t need to sort all the pieces manually. These small conveniences add as much as create an expert checkout expertise that prospects belief.

Extra Cost Conduct Statistics

- 48% of all buyers say having a number of fee choices is important when making a purchase order.

- About 13% of buyers abandon their carts just because a retailer doesn’t provide sufficient fee strategies.

- For 10% of shoppers worldwide, having the ability to use their most well-liked fee methodology is crucial function of their purchasing expertise.

- 2023 marked a historic shift in small purchases. For the primary time, money wasn’t the most well-liked selection for transactions below $25, with buyers preferring playing cards as a substitute.

- Individuals below 55 use money for simply 12% of their funds, whereas these 55 and older use it for 22%.

- 69% of shoppers say belief and safety are their prime considerations when selecting a digital pockets fee supplier.

eCommerce Cost Insights

The numbers don’t lie – the way you deal with funds can instantly influence your gross sales. Right here’s what the most recent eCommerce funds stats inform us about checkout success.

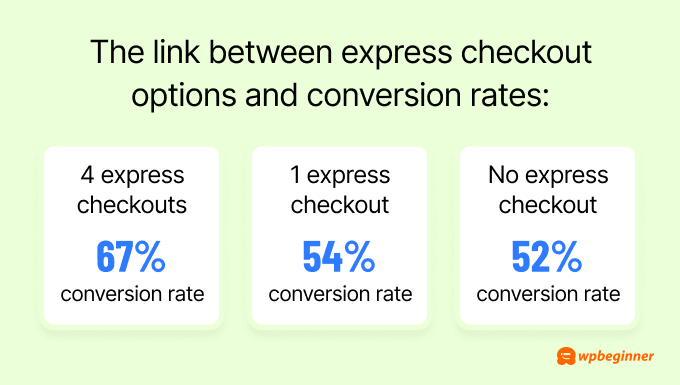

12. On-line shops with 4 specific checkout choices see 67% conversion charges, in comparison with 54% with simply 1 choice and 52% with no specific checkout.

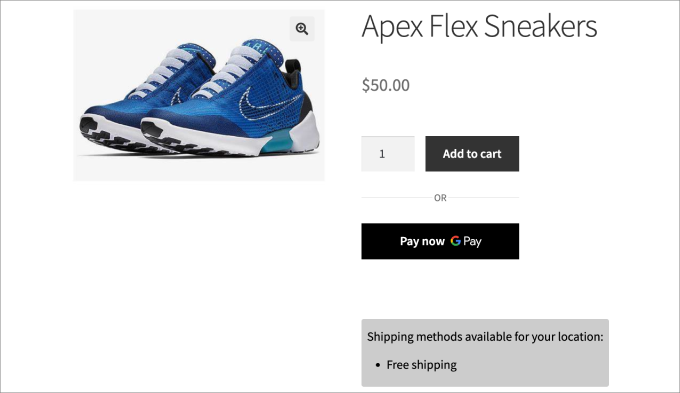

Express checkout lets prospects full their purchases with only one or two clicks utilizing saved fee data. Consider Amazon’s ‘Purchase Now’ button – options like this make shopping for quicker and simpler.

The upper conversion charges make sense. The less steps between wanting to purchase and finishing the acquisition, the much less probably prospects are to alter their minds.

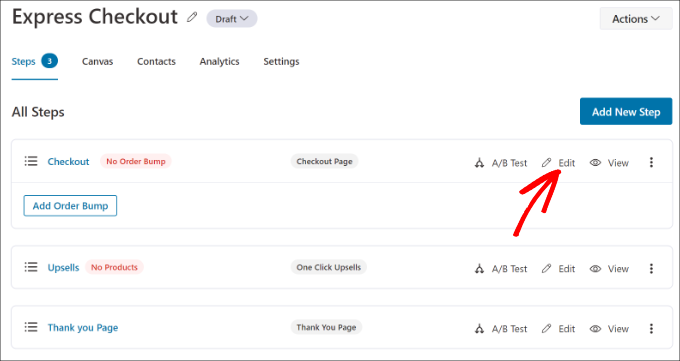

If you wish to add specific checkout to your WooCommerce retailer, then we suggest utilizing FunnelKit. It’s a sales funnel plugin that allows you to optimize your checkout course of, together with including specific checkout choices.

Moreover, it helps all of the fee strategies we’ve mentioned above. It even contains A/B testing options so you will discover the best-performing checkout format on your retailer.

You may be taught extra about all these options in our detailed FunnelKit review.

🚨 Need assistance with constructing your on-line retailer? Our WordPress specialists at WPBeginner Pro Services will help you create an expert eCommerce web site that converts guests into prospects. We’ll deal with all the pieces from design to WooCommerce when you concentrate on what you are promoting.

13. Checkout processes that take longer than 90 seconds can scale back conversion charges by 47%.

Velocity issues in on-line checkout. Whereas prospects shall be a bit extra affected person throughout fee than throughout searching, an extended checkout course of can nonetheless price you gross sales.

One approach to make your checkout quicker is to optimize your eCommerce website’s overall performance. This contains utilizing a very good internet hosting supplier, optimizing your photographs, and minimizing the usage of heavy plugins which may decelerate your checkout web page.

One other manner is to customize your checkout and take away pointless steps. For instance, you may scale back the variety of type fields and allow visitor checkout. These small modifications can scale back invaluable seconds off your checkout time.

You might also need to provide a one-click checkout. This lets prospects full their buy with a single button click on as a result of their transport, billing, and fee particulars are already saved.

This creates the quickest potential checkout expertise and may considerably enhance your conversion charges.

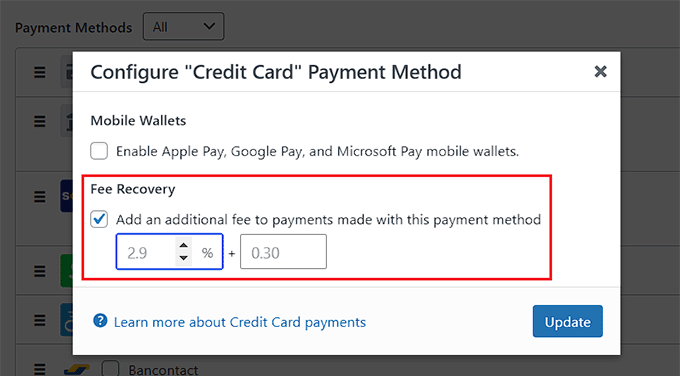

14. 36% of outlets say lowering fee processing charges is their prime precedence.

These charges can actually add up, particularly for smaller purchases.

For instance, when you promote a $5 merchandise, and the shopper pays for it utilizing PayPal, you′ll have to pay 3.49% + $0.49 per transaction. That’s nearly $0.67 on a single $5 sale.

Now, multiply that by 100 gross sales, and also you’re $67 in charges alone. For small companies promoting low-priced gadgets, these charges can critically lower into your earnings.

However don’t fear. You may scale back these charges in a number of methods.

One method is to pass payment processing fees to customers. This fashion, you may keep your revenue margins whereas being clear about prices.

In case you use Stripe as your fee processor, we even have an in depth information on how to reduce Stripe transaction fees that may aid you get monetary savings.

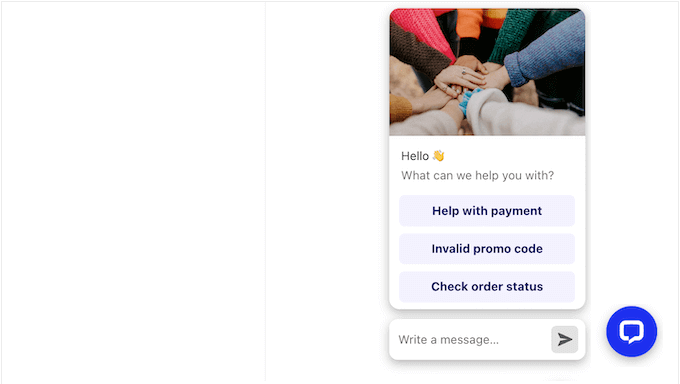

15. 35% of companies plan to put money into modern fee options like reside chat, social media funds, and synthetic intelligence.

These new methods to pay are altering how folks store on-line. For instance, prospects can now purchase merchandise instantly via Fb Messenger or make purchases throughout a reside chat session with customer support.

If you wish to promote via chat in your web site, LiveChat is a good choice. We use it ourselves on WPBeginner Professional Providers to speak with potential prospects.

The beauty of LiveChat is it could join with fee processors like PayPal and Mollie. This allows you to settle for funds, handle subscriptions, and deal with gross sales proper in your chat conversations.

Head over to our LiveChat review to be taught extra concerning the platform.

Extra eCommerce Funds Stats

- Good fee methods can enhance buyer retention by 15% to twenty%.

- Including common digital fee choices like PayPal, Apple Pay, and Store Pay can enhance conversion charges by as much as 50%.

- With regards to checkout design, single-page checkouts convert higher at 61% in comparison with multi-page checkouts at 56%.

- Whereas visitor buyers make up 59% of all eCommerce orders, they convert at 52%. That is decrease than registered prospects, who convert at 64%.

- Including new fee strategies can enhance gross sales by 24% in small companies.

- 48% of companies lose as much as 10% of their worldwide gross sales as a result of their fee processors don’t provide appropriate fee choices for world prospects.

- Cost failure charges sometimes vary from 5% to 10%, relying on location and fee methodology.

- Companies providing PayPal are likely to carry out higher, with 25% increased conversion charges total.

- Enterprises that use PayPal see even higher outcomes, with 33% extra accomplished checkouts in comparison with different strategies.

The Rise of “Purchase Now, Pay Later” Strategies

“Buy Now, Pay Later” services (BNPL) are altering how folks store on-line. Right here’s what you must learn about them:

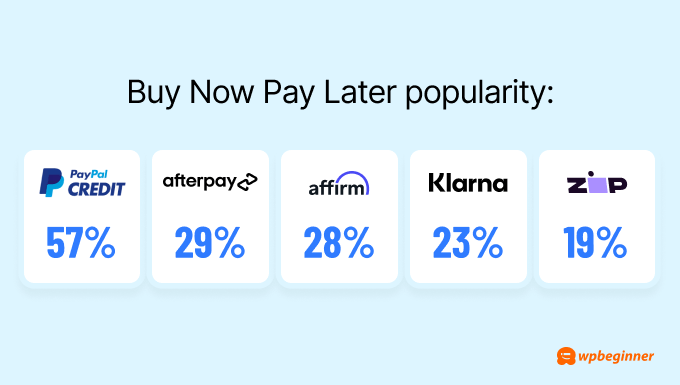

16. PayPal Credit score is the most well-liked BPNL service utilized by shoppers at 57%, adopted by Afterpay (29%), Affirm (28%), Klarna (23%), and Zip (19%).

These providers are common for various causes.

Some, like Affirm, don’t cost late charges, whereas others, like Afterpay, don’t specify a minimal buy quantity. There are additionally choices like Klarna, which have interest-free funds.

Earlier than including BNPL to your retailer, be sure that to analysis which choices your goal prospects want most. This fashion, you may provide the fee strategies they’re most probably to make use of and get your cash’s price.

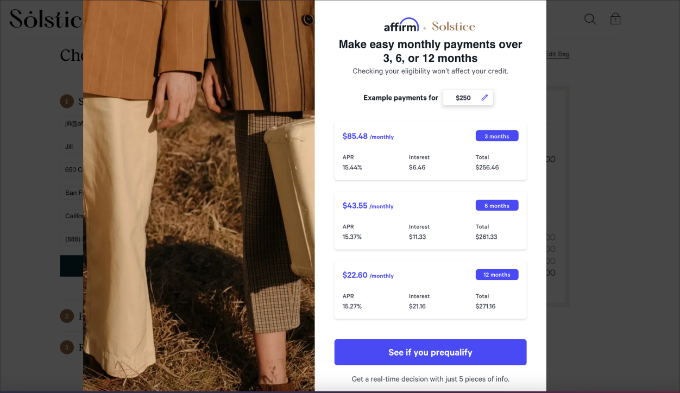

17. 4 in 10 buyers would select BNPL over bank cards for costly purchases.

This may very well be a game-changer for companies promoting higher-priced gadgets.

For instance, when you sell furniture, electronics, or premium providers, providing BNPL may aid you shut extra gross sales. That’s as a result of it could make bigger purchases really feel extra manageable for patrons.

18. 43% of vacation buyers select the place to purchase based mostly on BNPL availability.

This excessive share is sensible throughout the holiday season when folks need to unfold out their purchasing bills.

Nonetheless, earlier than including BNPL to your retailer, you must contemplate the prices rigorously. We’ve discovered that the processing charges for BNPL providers might be increased than common bank card charges.

You may also see extra returns with BNPL purchases as a result of this fee methodology typically encourages impulse shopping for. This could harm your backside line while you consider return transport and restocking prices.

In case you’re not assured in including BNPL providers, then you might need to contemplate enabling deposit payments as a substitute. That is far more simple as a result of you may management the deposit quantity and fee phrases.

Extra BNPL Statistics

- 29% of shoppers have used BNPL providers, with one other 15% saying they’re fascinated by making an attempt them.

- Customers select BNPL for 3 essential causes: simpler checkout (45%), fee flexibility (44%), and decrease rates of interest (36%).

- Half of each Gen Z and Millennial buyers use BNPL platforms for purchases, making them the most probably age teams to make use of this fee choice.

- 58% of BNPL customers maintain their month-to-month funds modest at $100 or much less.

- Electronics tops the BNPL buy checklist within the US, with 50% of Individuals utilizing these providers to purchase them.

- 80% of BNPL customers begin their purchasing at BNPL supplier web sites relatively than retailer websites.

- 68% of BNPL customers resolve to make use of installment payments earlier than reaching checkout.

- When given a selection, 40% of BNPL customers would have used bank cards as a substitute, whereas 29% would have used debit playing cards or money.

- PayPal Credit score drives twice as many purchases in comparison with their normal checkout choice.

Cell & Contactless Funds

When speaking about digital funds, it’s essential to speak about cell and contactless choices as a result of they’re rapidly changing into the norm.

Let’s see how these fee strategies are reshaping the best way folks pay.

19. 46% of card customers have switched to contactless fee strategies like cell funds, digital wallets, and on-line banking.

The comfort of paying with only a cellphone faucet or fast scan has made conventional card swipes really feel outdated.

For brick-and-mortar enterprise house owners, this implies you have to to make sure your fee system can deal with these trendy fee strategies.

20. QR code funds are set to develop by over 590% in Southeast Asia.

QR code payments have gotten common as a result of they’re easy to make use of and don’t require costly {hardware} – only a smartphone digicam.

This fee methodology is very widespread in Southeast Asian markets.

For instance, in international locations like Thailand, prospects typically pay by scanning QR codes via apps like GrabPay or their native financial institution apps.

21. Biometric funds are anticipated to succeed in 1 billion customers by the tip of 2025.

Whereas this sounds spectacular, contemplate rigorously whether or not what you are promoting wants biometric fee choices. Biometric funds make extra sense for high-security transactions or particular industries like banking and healthcare.

In case you’re operating a typical WordPress website, specializing in common fee strategies like digital wallets and card funds will serve your prospects higher.

Extra Cell Cost Statistics

- Due to the pandemic, 79% of shoppers globally now use contactless funds.

- In america, 70% of retailers say prospects are asking for contactless fee choices.

- Most customers entry digital wallets via smartphones (68%) or smartwatches (41%).

- Technology Z leads the contactless fee pattern. They’re 61% extra probably than different age teams to make use of tap-to-pay for his or her debit transactions.

- Wanting forward, QR code funds within the US are anticipated to realize 16 million new customers by the tip of 2025.

- The marketplace for biometric fee authentication is projected to develop 20% yearly, reaching $15.8 billion by 2027.

Different Cost Strategies

Past conventional playing cards, digital wallets, and BNPL providers, a number of different fee strategies are gaining traction. Let’s take a look at some attention-grabbing traits:

22. About 80% of US buyers who use cryptocurrency for funds select Bitcoin.

Whereas crypto funds aren’t mainstream but, they’re rising in popularity amongst tech-savvy prospects. Some patrons want crypto due to its privateness options, whereas others recognize avoiding foreign money conversion charges for worldwide purchases.

For companies, accepting crypto can imply decrease processing charges and no chargebacks. It is because crypto transactions are verified by the blockchain community as a substitute of banks or card corporations, making them closing and safe.

In case you’re fascinated by including this feature, take a look at our information on how to accept Bitcoin payments in WordPress.

23. In Europe, 25% of on-line purchases are paid via financial institution transfers utilizing the SEPA system.

SEPA (Single Euro Funds Space) is a fee system that makes financial institution transfers as simple as native funds throughout 36 European international locations.

It’s common as a result of it’s safe and often has decrease charges than bank cards. What’s extra, it feels acquainted to European prospects who often use financial institution transfers.

For companies promoting to European prospects, SEPA funds provide a number of benefits. There’s no danger of chargebacks, charges are sometimes decrease than bank cards, and funds are assured as soon as cleared.

If you wish to faucet into the European market, we’ve got an in depth tutorial on how to accept SEPA payments in WordPress that will help you get began.

Extra Different Cost Statistics

- The cryptocurrency fee market is rising quickly, anticipated to extend by 70% yearly and attain $4.5 billion by 2026.

- The Automated Clearing House (ACH) Community processed 8.4 billion funds price $21.5 trillion within the third quarter of 2024.

- In Europe, Giropay has emerged as a big participant, rating because the tenth hottest fee processor globally.

Cost Safety & Belief Statistics

With on-line fraud on the rise, fee safety has turn into a significant concern for buyers.

Let’s take a look at what the previous couple of digital funds stats inform us about safety and belief in on-line transactions.

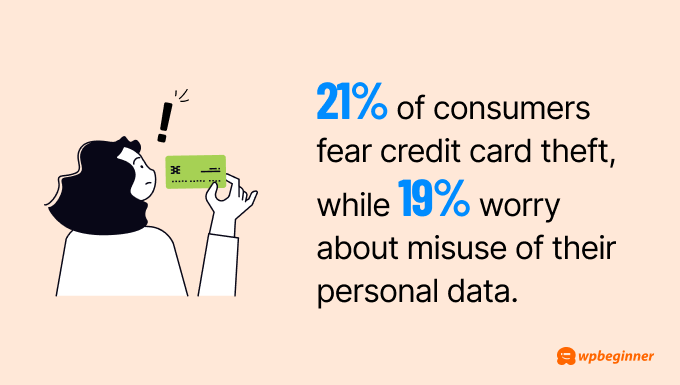

24. 21% of shoppers worry bank card theft, whereas 19% fear about misuse of their private information.

This concern is well-founded, contemplating the quantity of fee fraud right this moment. Within the US alone, 52 million Individuals have had fraudulent prices on their playing cards, with unauthorized purchases including as much as greater than $5 billion.

For that reason, it’s essential to make your fee course of as safe as potential and present prospects that their information is protected.

You additionally need to secure your WordPress website in all areas to stop hackers from accessing delicate fee data in your website.

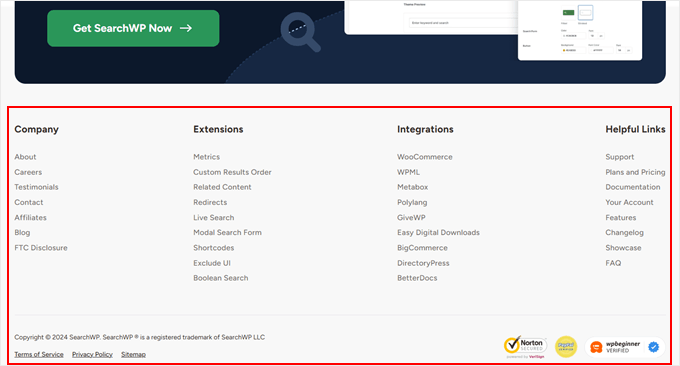

25. Including belief badges to fee types can enhance conversions by 42%.

Belief badges are these small safety symbols you typically see on a website or throughout checkout, like Norton Secured or VeriSign.

Consider them as digital variations of storefront safety system stickers – they present prospects your website is protected.

These badges work as a result of they supply visible social proof that your checkout is safe. When prospects see acquainted safety logos, they really feel extra assured sharing their fee data.

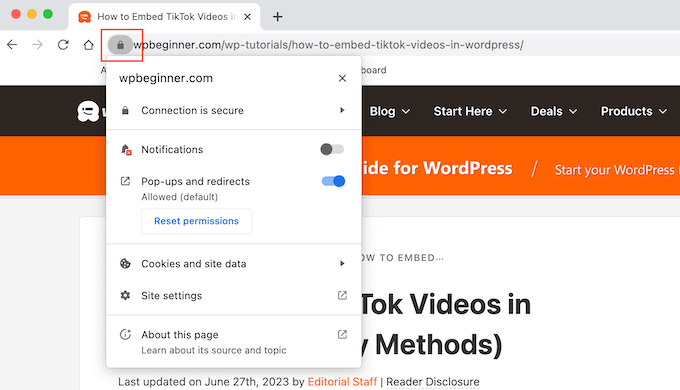

Apart from belief badges, you must also allow an SSL certificate in your web site. This provides the padlock icon within the browser’s handle bar and encrypts buyer information.

It’s particularly essential as a result of Google warns guests about web sites with out SSL. This could scare away potential prospects earlier than they even attain your web site.

26. Companies that completely check their fee methods see 25% fewer losses from fraud.

When testing funds, you must search for a number of key points.

First, test in case your payment forms deal with errors accurately, like expired playing cards or inadequate funds. Then, you have to to see if the transaction quantities are correct and that buyer information is being correctly encrypted.

You must also check in case your fraud prevention measures can catch suspicious actions, like a number of failed fee makes an attempt.

In case you use WP Easy Pay, you should utilize its fee testing mode to simulate completely different fee situations.

This fashion, you may catch potential issues early and guarantee your fee system works easily when actual prospects make purchases.

Extra Cost Safety Statistics

- 7 in 10 shoppers have safety considerations about one-click checkout options.

- Companies that optimize their fee processes can see conversion rates enhance by 10-15%.

- Automated testing of fee methods can scale back fee bugs by as much as 40%.

- Between 25% and 50% of on-line shops don’t provide essential options like two-factor authentication, value matching, and low cost coupon code capabilities.

- 41% of companies had been in a position to get well a minimum of 75% of stolen funds in 2023.

- Nonetheless, 30% had been unable to get well any cash in any respect.

Sources:

ABSR (Absolute Business Solutions & Research), Association for Financial Professionals (AFP), Bank for International Settlements (BIS), Bankrate, BlueSnap, Boston Consulting Group (BCG), Capital One Shopping, Chargeflow, eMarketer, Federal Reserve Services, Fit Small Business, Forrester, IBS Intelligence, Market.us, McKinsey, Merchant Savvy, PayPal, PYMNTS, Statista, Testlio, and Worldpay.

That’s all for our checklist of on-line funds statistics, information, and traits it’s essential to know. We hope these insights have been useful to you.

If you wish to learn extra research-based articles like this one, then take a look at the guides under:

Discover Extra Helpful Insights for Your On-line Enterprise

In case you appreciated this text, then please subscribe to our YouTube Channel for WordPress video tutorials. You may as well discover us on Twitter and Facebook.